Trump’s economic approach

Donald Trump and his Republicans won convincingly the last US elections and how they did it showed that Americans would need something new to nourish hope for a better future, no matter how they had been living so far. The pre-election polls indicated that many were unhappy with their domestic economy. The genius of Donald found the best solution in this sophisticated in its existential complexity situation. In fact, he had it ready-made for a long time – he only repeated that he would make America great again and he included all the pending problems of the gifted with faith people in the suggested solution. A large mass of these people really believed him. Good for them! I also strained my natural abilities to trust him but I failed. Perhaps, because I am not an American or because my spiritual grasp is too poor. After I felt thus humiliated by my being nowhere, I decided at least to try to demonstrate a bit of solidarity with some people of my own clay and eventually console them by offering to their attention a small analysis originating from inevitably mediocre brain efforts. That was why I made up my mind to upload the present post, full of charitable intentions as I said, but blemished otherwise by my limitations to comprehend the immense Donald’s intellectual power.

So, keeping a low profile, I dare to think that Donald although a genius, is completely wrong with how he translates social unhappiness to the economy. First, he is mistaken in his selection of the problem that he intends to solve as fundamentally important for the improvement of public happiness. Mr. Trump wants to curtail the US trade deficit to make America great again. But why on earth does he assume that the deficit may define the shrinking of the US GDP share in the world GDP and not vice versa? Can the deficit solely by itself make America less great apart from its GDP weight diminution in the global economy? The answer, of course, is no.

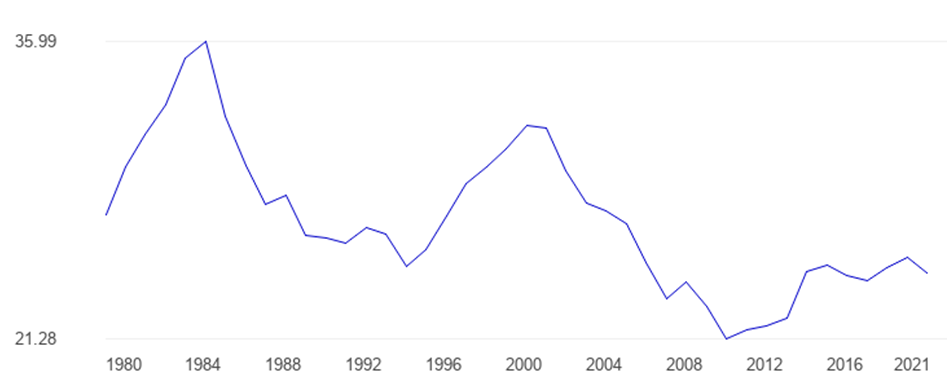

The US GDP share in the world GDP

Source: https://www.theglobaleconomy.com/USA/

Then Donald is wrong about his correction choice by which he wishes to resolve the problem with the trade deficit. It is not clear how Donald will increase the US impact on the global economy by diminishing the country’s import levied eventually with his tariffs instead of augmenting the national export. China proved in 2016 – 2020 during his first mandate that it could re-shore its US exports when levied with tariffs in a few sectors. And what will happen further if the reduced import brings reduced American exports too? What about the gradual pushing away of the US dollar from international payments with the reduced imports? When one considers the growing share of the Chinese economy in global trade, he or she will answer these two questions straightforwardly by himself/herself without waiting for me to waste his/her time with comments at whose expense everything is going to be done:

The Chinese GDP share in the world GDP

Source: https://www.theglobaleconomy.com/China/

Ok, you may ask, but why should the US domestic economy suffer from its partial loss of global influence? Because it loses thus competitiveness and not the trade deficit brings this loss but the deficit comes in place as a result of the worsened competitiveness, including by the overestimated US dollar exchange rate effects on the American export. The prospective tariffs of Mr. Trump will only try to defend the process of continued competitiveness loss, making it more sustainable. Weakening the competition domestically is a move in just the opposite direction to the course towards gaining greatness, i.e., the US economy will become more and more vulnerable to domestically born inflation and US dollar international devaluation pressure as well as depended on international supply chains dominated by someone else (most often by China). Besides, after the inflation hike usually is coming redundancy – as an issue of the overestimated manpower that once is becoming overestimated cuts off an extra piece of competitiveness from the domestic economy. The same thing formulated in simpler words means that many US employees currently not happy with their wages will be deemed later unworthy even for them.

Well, I can imagine that somebody may be sceptical about my assumption related to the importance of the competitiveness loss stemming only from the falling share of the US economy in the global one. That is why I shall point out an additional proof in favour of my opinion. It comes from the World Trade Organization (WTO) database which displays the growth export index in merchandise trade value and volume (2015=100) for the world economy in 2024 as the value accounts for 144.63 while the volume for 113.82. These indicators for the US economy are 134.48 and 111.75 respectively. Under these circumstances, it is impossible to see the American economy as great and strongly competitive if it generates smaller value and volume growths than the rest of the world. It means that it lags behind and the slipping in parallel industrial productivity in the last decades (3 – 9% during the first Trump mandate) both tell us why the imports outweigh the exports in the trade balance nowadays. If Donald manages however to shrink the US imports by tariffs then how will he make automatically the American economy produce more value and volumes?

The answer to this question naturally is beyond the verbal stream of promises made by Mr. Trump. It is by investments in industrial capacity enlargement. But why to invest in the industry? Because exactly the industrial products are what America imports mostly and this kind of import surpasses the ones of the EU and China as share in the GDP. Then the U.S. keeps smaller shares of local industrial contributions to the GDP than it is with China and Europe of course. Smaller such contributions presume on the other hand less innovations and a more modest degree of overall competitiveness compared to China, even when the R&D expenditure of America is bigger:

Items USA China Germany Japan

R&D expenditure, % of GDP 3,46 2,43 3,14 3,3

IT exports, % of GDP 7,85 22,64 4,77 8,16

High tech export, % of manufactured export 17,85 23,12 15,99 13,37

Patent applications by residents 262 242 1 426 644 39 822 222 452

Source: https://www.theglobaleconomy.com/economies/, data period 2021 - 2023

It is obvious that Mr. Trump’s tariffs again have nothing to do with any competitiveness improvement (incl., bettering the trade balance), this time through the innovation perspective.

Another paradox with the tariffs is that Donald wants to impose them together with an introduction of tax reductions and cancelling the subsidies of the Chips Act and IRA. He is a thrifty man, but it diminishes significantly the government’s potential to support investment policies. Without them, Mr. Trump has no useful moves to counteract the issues coming from the US economy’s receding share in the world economy. His tariffs cannot bring a lot of alternative revenue if they are going to be protectionist, i.e., decreasing the import. If they do not decrease the imports, then the trade deficit will not shrink, either. The poor Donald in both cases is putting himself in a trap!

Furthermore, it is not seen how the US economy can mobilize a large chunk of private investments aimed at re-industrialization necessary for its competitiveness enhancement and trade balance steady improvement after Mr. Trump refused to use subsidies for that purpose. The personal savings rate has been stable at a level close to 6% (in China it is above 40%) for many years, the personal income has not undergone essential growth in the last nine years (no wonder then that a lot of people are not happy and trust Mr. Trump’s great America again promise, especially in some states with higher poverty rates) while despite of these two facts, the Americans continue to increase their consumer spendings every year. Add to all that the traditional lack of bank credits for launching new industrial projects and the high cost of the capital raised on the stock markets and you will see how the isolationist economic model of ‘America great again’ simply does not contain real drivers for economic development. Even an eventual devaluation of the US dollar aimed at stimulating export alike the tariffs will bring in mainly inflation, but not investments in an environment in which no structural reforms are envisaged. The absence of this kind of reforms is well displayed in the fact that in the period 2015 – 2023, the gross fixed capital formation went up by 31.65% whereas the cumulative inflation rate reached 33.18%, i.e., there was no real fixed capital formation. Instead the trade balance in the services sector was positive while the same one with the commodities (especially industrial) was not.

In other words, Mr. Trump promises one big nothing with his ‘America great again’ and the tariffs. Like his predecessor Mr. Biden he has no heart to say that America is just not competitive to a healthy degree and its problems come primarily from it. Are the American presidents so reticent on the economy because the US elites are not yet prepared for radical reforms? I do not know. But I heard that Mr. Trump invoked someone to ‘drill, drill and again drill …’

Geopolitics

If the US economy is stepping back globally and the national elite does not want to react adequately to the fact, then what can we expect from Donald’s geopolitics? It is rather possible to sacrifice Ukraine in the hope of separating Putin from comrade Xi. However, this will hardly work, because Putin does not have a big need of America, neither of Europe of the Green Deal. It is too abstract to imagine any collaboration between Vladimir and Donald based on drilling alone. It cannot consolidate the US elites, either, but can earn some dollars for Donald+cronies and Vladimir. Ukraine will be left to Europe’s mercy in this scenario. But it is not certain whether Vladimir who is no smaller nationalist than Donald would play in it. I suppose that he will not, because he has bigger ambitions. And comrade Xi is more important for them than Donald.

Even so, Donald will work hard on the decoupling from China. It seems inevitable when he has no real plan for improving the competitiveness of the American economy. But without radical economic reforms, he will work in the wrong way. China will redirect its exports mainly to Asia and ASEAN countries whose economies are among the most dynamic in the world and the U.S. will lose their markets almost completely (hopefully, not entirely). This will make the axis of China – Russia – Iran – North Korea stronger and more resourceful. The EU will also approach China somewhat although it is not possible to predict right now how much it might be. Donald meanwhile will struggle with inflation in an isolated America. At last, one day, his second term as president will expire and he will retire. Till then perhaps more people among the American elites will get wiser and have more will to fight the chaos. That is why the biggest hope with Donald is linked with the chaos. Otherwise, comrade Xi and Vladimir will install their multipolar new international order giving America only the gracious chance to find its right place in it.

What can America do now with its economy?

It can start reforms around the following priorities:

- Make a tax reform favouriting manufacturing sector and personal savings;

- Reallocate through the government budget a bigger part of its GDP by subsidies until rising the savings rate;

- Work out a supporting system administered by the government and some insurers aimed at leveraging bank loans for new manufacturing projects;

- Increase the excise on the carbons;

- Support by subsidies for the re-shoring in Eastern Europe of some of the US manufacturing businesses or parts of their logistic chains;

- Subsidising the opening of machine-building enterprises intended to help its re-industrialization, including by re-shoring in some cases;

- Implementing a cap-and-trade system for imports, similar to those used for greenhouse gas emissions, will help manage the trade deficit by setting limits on imports and allowing market forces to determine the allocation of import licenses;

- Start Electronic design automation software (EDAS) run only on US cloud base servers;

- Introduce and apply a customs control system that will be able to identify Chinese parts and components in all kinds of imported devices and machines in order to ban their import into the USA;

- Apply targeted tariffs but not blanket ones;

- Improve the procurement legislation by allowing smaller tech companies to be competitive in the tenders;

- Conclude relevant Trans-national Trade Agreements;

- Invest heavily in building and supporting Ukrainian defence industry vs. negotiated beneficial access to the Ukrainian lithium deposits;

- Subsidise green industries (manufacturing EVs, batteries, solar panels, etc.);

- License the production of legacy chips in Eastern Europe in a new standard which will not be sold to Chinese or China related entities;

- Relocate internally unemployed emigrants to poorer states (or depopulated areas) and setting up there low tech/simple productions which to hire them;

- Launch educational and training initiatives related to the reforms described above.