The dollar has slumped since Trump launched his trade war. Photo: Arun SANKAR / AFP/File Source: AFP

As President Donald Trump's tariffs threaten the US economy, questions are being asked about how long the dollar can maintain its status as the world's key trading and reserve currency.

AFP examines the greenback's current situation and outlook:

Is the dollar still all-powerful?

The dollar, whose strength is based on the economic and political power of the United States, is traditionally considered a preferred safe haven in times of crisis or conflict.

Almost 58 percent of foreign exchange reserves together held by the world's central banks were denominated in dollars as of the final quarter last year, according to the International Monetary Fund.

The dollar emerged as the new reference currency under the Bretton Woods accords of 1944, which laid the foundations for the current international monetary system.

Many countries have since chosen to peg their currency to the US unit, while demand for dollars has allowed the world's biggest economy to borrow freely, theoretically without limits, with its debt largely owed to foreign investors.

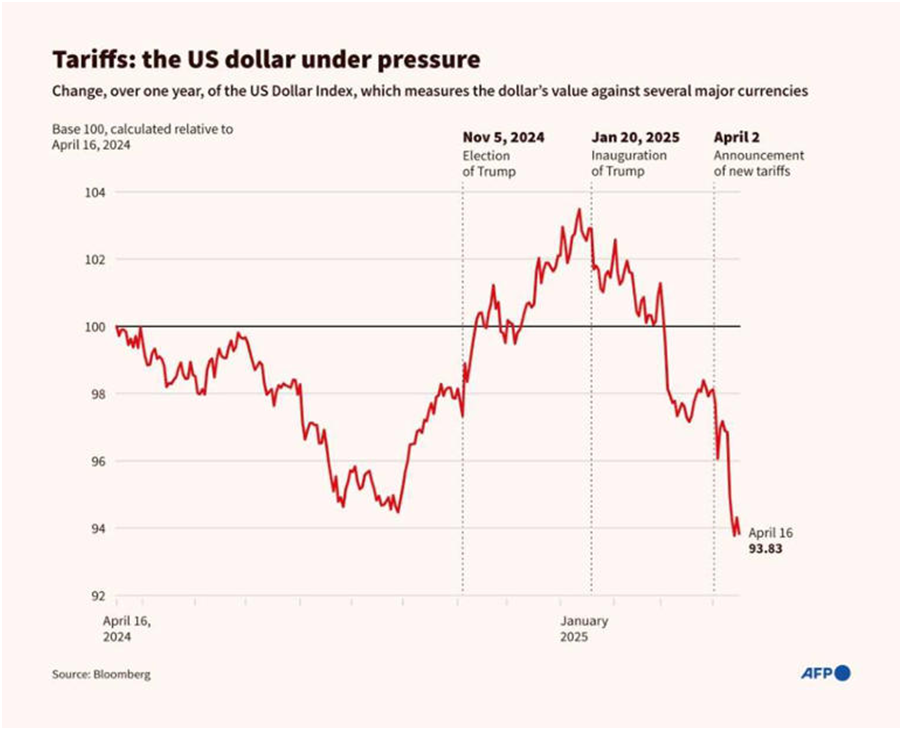

Tariffs: The dollar under pressure. Photo: Yann SCHREIBER, Paz PIZARRO / AFP Source: AFP

Former French finance minister Valery Giscard d'Estaing described this economic advantage enjoyed by the United States as an "exorbitant privilege", ahead of becoming French president in the 1970s.

On the other hand, the relative strength of the greenback despite recent turmoil makes American exports more expensive.

Looking at why the euro is not ready to take the helm, he added that the European single currency is "fundamentally still governed by individual nations that have mixed incentives to cooperate".

Among other units, he said the Canadian and Australian dollars, as well as the Swiss franc, are limited by the modest size of their markets.

As for the yuan, it remains under Beijing's strict control, owing to the lack of free convertibility and restrictions on capital movements.

However, the experts are adamant that the biggest loser from the US tariff policy is the US dollar. Unlike stock markets, which have managed to recover a significant part of their losses, the US currency shows no signs of such recovery, Deutsche Welle reported.

The euro has reached a three-year high against the dollar

Investors reacted to Donald Trump's new higher tariffs by selling dollars and fleeing to the euro, yen and Swiss franc. We are witnessing a dramatic development without parallel in the history of stock markets, the German publication points out.

This development reflects investors' fears about the consequences of Trump's chaotic tariff policy. The market assesses the risks to the growth of the US economy higher than inflation risks. Experts believe that the risk of the US falling into recession due to higher import tariffs has increased dramatically. Of course, the biggest problem here are not the tariffs by themselves but the inconsistent way they are applied.

"The damage is done, the trust is broken"

The dollar's status as a safe haven has quickly evaporated. The market is starting to question the dollar's role as the world's reserve currency. The recently announced exemptions from high tariffs on smartphones, laptops and cars are not expected to change this, because companies still have no certainty in their planning. How long the "temporary" exemptions will apply - everything depends on President Trump's next move.

"The damage is done, and the trust is broken," Commerzbank currency expert Antie Prefke told ARD. As long as this uncertainty persists, a significant recovery in the dollar is unlikely, she added.

Why does Trump want to weaken the dollar?

Trump himself is probably watching the dollar sell-off calmly, since weakening it as the world's reserve currency is one of the stated goals of his tariff policy. The logic behind this is as follows: A weaker national currency reduces the gigantic national debt, as well as the US trade deficit, explains ARD.

Well but the current depreciation of the dollar is more of an "unplanned" side effect of the introduction of tariffs by Trump and his advisers. Their goal is rather to force US creditors into a coordinated devaluation of the dollar in the coming days and weeks, thus increasing the competitiveness of American exports. The key word here is "Mar-a-Lago agreement".

What does the "deal" for the depreciation of the dollar envisage?

The idea is from Stephen Miran, the new chairman of the Council of Economic Advisers to the US President. It envisages, as in the Plaza Accord in 1985, that foreign creditors be persuaded to convert their US government bonds into those with an extremely long term of 100 years and with low or, at best, no interest. However, no country would voluntarily agree to such an exchange unless it was threatened with high tariffs or the withdrawal of military protection from the US, ARD points out.

The German publication also recalls what the Plaza Agreement in question achieved at the time: It was signed on September 22, 1985, by the five leading economic powers at the time - the US, the UK, Germany, France and Japan - at the Plaza Hotel in New York. The aim was to weaken the dollar in order to reduce the growing US trade deficit. As part of coordinated actions, central banks sold US government bonds from their holdings. The Plaza Agreement led to a sharp rise in the value of the yen and the German mark against the dollar.

Trump and Miran are playing with fire

Experts are convinced that Miran and Trump are playing with fire. Moritz Kremer, chief economist at the Baden-Württemberg Regional Bank, describes the idea as "extremely dangerous".

"In all financial crises, US government bonds have been a safe haven. This 'Mar-a-Lago deal' will undermine that haven. And the result will be a global financial crisis," warns Kremer.

In fact, if the dollar ceases to play the role of reserve currency, the consequences, especially for the US itself, would be dramatic: Demand for the dollar would no longer be natural, and demand for US government bonds would also fall significantly. Profits, and therefore the interest that the US government has to pay to its creditors, would increase.

This would put an end to the easy refinancing of US government debt on the financial markets. The US government would no longer be able to borrow unlimited amounts of money - something it needs, considering that the US is the most indebted country in the world in absolute terms, with almost 37 trillion dollars, ARD also recalls.

American companies and consumers, and therefore Trump voters, will also be directly affected by the dollar’s collapse. It will deal a heavy blow to their well-being, and they will thus bear the consequences of their president's confused economic policy. Economists from Goldman Sachs suggest that even generous tax cuts will not be able to compensate for this. So, America’s favourite, Mr. Trump, without having the honesty to announce an economic course towards austerity, absolutely necessary for America today, in fact, will have it due to society’s naivety. And the way it is determined, it hardly would lead to an investment boom. Therefore, it is not presuming structural changes in the US economy aimed at reindustrialisation. Under these circumstances, the looming austerity can be expected to be an austerity of stupidity instead of reforms and a following economic upsurge.

Miran's expectations are not coming true

Did Miran and Trump think this through well? In fact, the US government's economic policy concept has so far turned out to be too short-sighted and ill-considered in many respects, and many of Miran's own expectations have not been confirmed.

For example, in his concept from November 2024, Trump's advisor predicted that the announcement of US tariffs would pass almost without any shocks on the stock markets. However, we have seen that the reality is different.

The EU and China Chance

The EU and China’s chance in this situation is to deprive America of its useful move to devalue the US dollar. This can happen quite in a Trumpist fashion – both parties should make a deal and show the deal master that he is barefoot, if not completely nude. The EU and China need to start immediate consultations on how to negotiate trade quotas for key commodity groups for at least 3 years ahead. Then they should fix a settlement in euros on the quotas. It is not needed for the EU to break its tariff negotiations with the US government and both negotiations could take place in parallel. The EU should expect China in exchange to sell outright a large stake of its US bond holdings, which would devalue the US government bonds on the international capital markets. Thus, Trump will miss the chance to reduce the cost of America’s state debt and he would not be able to refinance its servicing at a lower cost, nor to increase it further cheaply. To cover the Chinese loss from the US bonds sales, the EU may offer its partner some purchases of newly EU issued bonds, addressing its rearming policy, especially in the fields of common infrastructure, software and satellites construction as the use of all these elements currently makes the EU depended on the US defence industry. Organising thus its approach, the EU and China will press down America in a twofold manner – first, the dollar demand will not grow, because of its trade utilisation decrease, primarily defined by Trump’s tariffs and second, the dollar would have a limited potential for devaluation. The latter would make the US debt servicing hard and the US trade deficit will not go down without the Americans reducing their domestic consumption at last. All that would incentivise the FED to diminish the interest rates and then America should enter perhaps into an inflationary spiral, standing up versus reciprocal tariffs. The opposite movement of the rates will bring a quick recession. As a result, Mr. Trump would be able to learn the lesson that being an idiot is not a privilege, but it is usually a disadvantage in real life. Hopefully, many Americans will learn the same lesson, too. The world, if lucky enough, should free itself from the American illusions that the U.S. can solve its economic and geopolitical problems at the cost of everyone else, just proclaiming ‘’America first’’. Besides, this approach guarantees Europe a fair grounding of Mr. Trump and Mr. Putin in its foreign policy. China has a more vivid need for a strong Europe than Trump and Putin as well. Trump will have 90 days to decide what to do in the situation with his global tariffs. During the same days, the EU may have its own term to decide whether the Ukrainian army could be supported as a common European supranational army with the frozen Russian assets in Europe.