Two Key Structural Loop Holes in the Western Economies at the Beginning of Cold War 2 Apart from the Mature Chips Production Shortage

Part 1: Electric Vehicles (EVs)

China is the biggest global EV manufacturer. The EV market growth is inevitable.

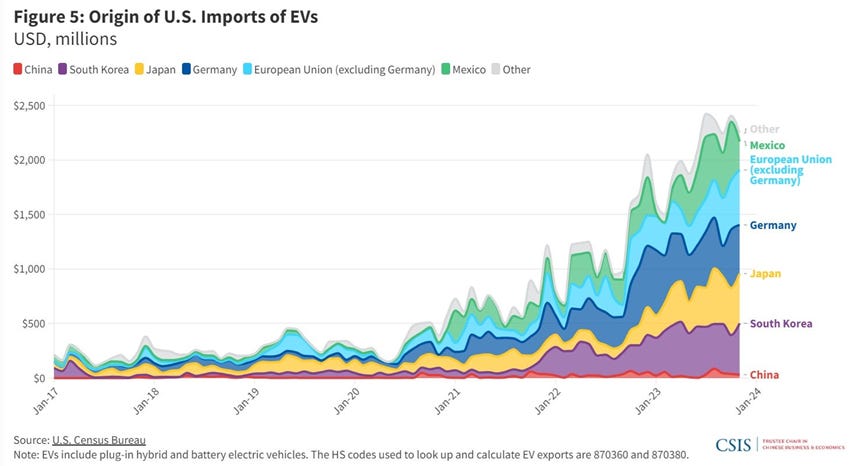

Joe Biden has slapped 100% tariffs on Chinese-made electric vehicles. It means that they will not be sellable in the USA. According to a report called “Ain’t No Duty High Enough” of Rhodium Group, Europe would need 40-50% tariffs to keep Chinese EVs out. However, such tariffs did not quite come into effect as the highest duty applied in the EU meanwhile went up to 37%. It would be charged only to those Chinese EV manufacturers that had not collaborated with the EC in its preliminary probing into the competition in the sector. But few people in Europe expected even this percentage after Germany had been firmly opposing the tariff increase. As it is now, however, the introduced tariff will leave some relatively comfortable margin for the Chinese exporters. On the other hand, the US tariff perhaps will nuke all Chinese EV exports to the country, although it will result in essentially zero change to anyone’s life. The reason is that China currently sells almost zero EVs to the USA.

That does not mean the tariffs in America are performative. They are preventative. In the past, we have seen examples of how China suddenly floods the U.S. or other countries with a massive amount of a certain export product — for example, excavators. Biden’s tariff will ensure that this does not happen with EVs. Therefore, they are a move dictated by political motives (an understanding of prevention) and a shred of evidence for how Cold War 2 politics in the West could determine business processes.

So is that determining good or bad? Will Biden’s move give a boost to the U.S. auto industry? Will it slow down the green transition in America?

The precaution is good for America because it will not make EVs more expensive domestically. First, since they are not a best seller, and second China may sell its EVs in the U.S. by manufacturing them in Mexico. It may equally construct manufacturing or assembly units in the USA, too. Still, there are no confirmations for either of these options to be aimed by any Chinese company. What will happen in the future however is to be seen.

What do the tariffs mean for the U.S. auto industry?

Biden’s tariffs will give U.S. car companies like GM and Ford a temporary reprieve from a potential wave of Chinese import competition. But unless Biden — or a future President Trump — put tariffs on EVs made in Mexico as well, the respite will be short-lived, because GM and Ford will still face brand competition from Chinese automakers in their domestic market.

That competition will hit not just GM and Ford’s nascent EV business but their entire business. Internal combustion engine (ICE) cars and EVs are in direct competition with each other. And several factors favor EVs over ICE cars in the long run. These include:

1. Government efforts to accelerate the green transition

2. The fact that battery tech is improving by leaps and bounds while ICE tech is basically stagnant

3. The fact that battery costs are plunging every year due to scaling effects (largely from China)

4. Home charging

ICE cars have to fill up often, unlike EVs, which charge overnight in people’s garages and so only have to visit charging stations on long trips. So ICE cars require a dense network of gas stations to be viable. As EVs start to take over the market and ICE cars become rarer, many of American existing gas stations will go out of business. That will make it less convenient to own an ICE car, which will accelerate the shift to EVs.

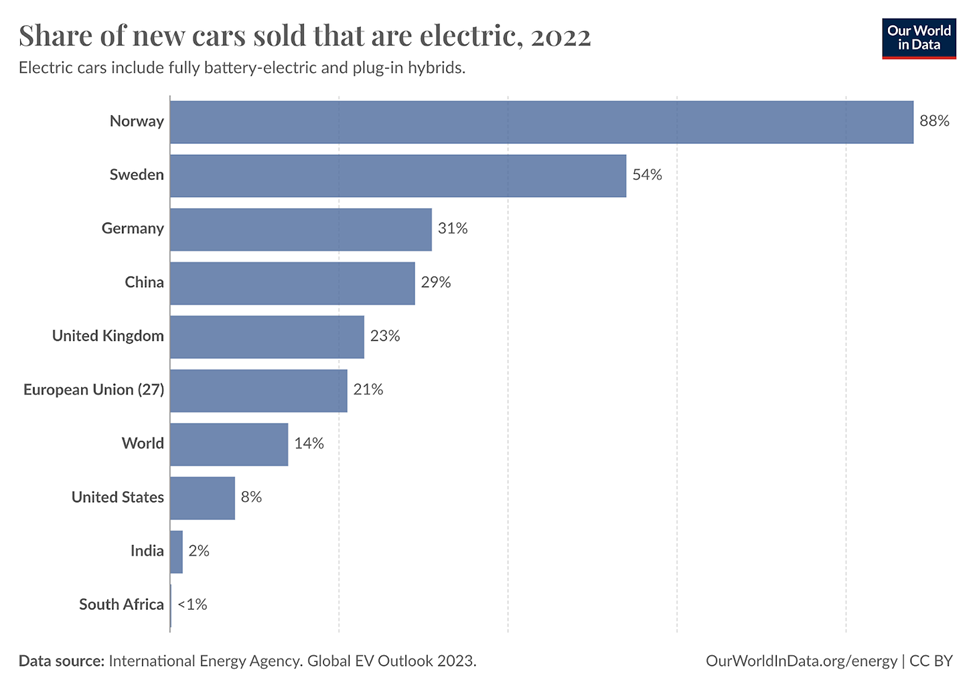

Right now, that is not happening. The market for EVs in the U.S. is still increasing, but not as fast as many had expected. It is weaker than in Europe and China, and it is even in percentage intensity under the world average.

As a result U.S. automakers are scaling back their EV plans.

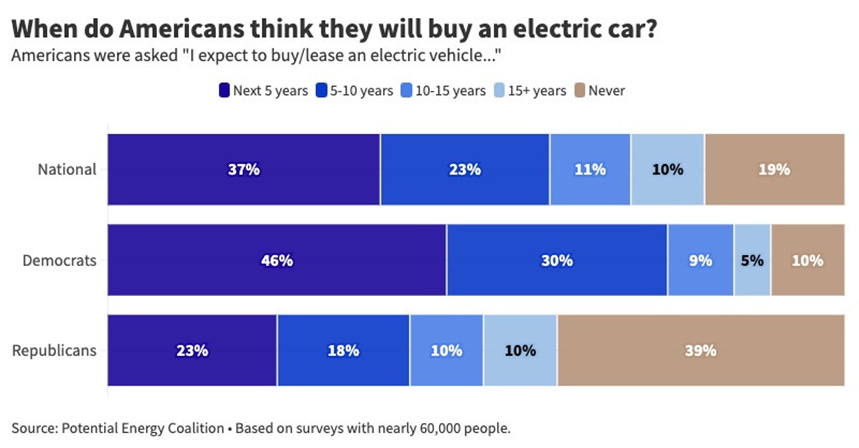

But most Americans — except for a hard core of conservatives who have turned green technology into a culture war — expect to get an EV in the not-too-distant future.

If GM and Ford scale back their offerings, and if Tesla focuses on robotaxis instead of new better EVs, then there is a high likelihood that the EV revolution in America will be carried out by Chinese companies building cars in Mexico. It should be noted that only China could currently sell large numbers of quality EVs at prices similar to the ones of ICE cars due mainly to its vertical industrial integration in the sector and various subsidies. Tariffs will not stop that unless A) America levies similar tariffs on Mexico and any other country, and B) Chinese car companies refuse to build factories in the U.S.

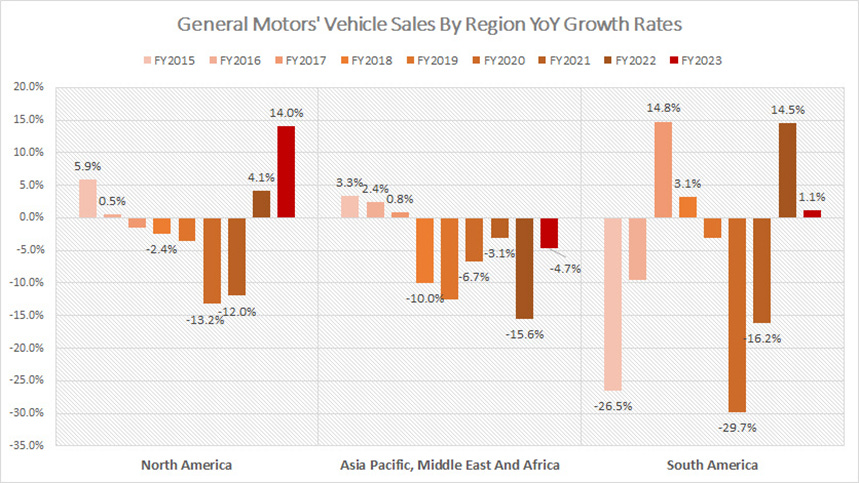

And there is something else that no U.S. tariff can stop: American car companies are getting outcompeted in export markets.

Ford makes the bulk of its money from North America, but GM makes as much or more revenue in Asia, as does Tesla. U.S. tariffs obviously do not apply to Chinese EVs being sold to Vietnam, or Japan, or Australia, or anywhere else except the U.S. So they will do absolutely nothing to help U.S. automakers compete in key foreign markets. Many of those other countries are unlikely to put up giant Biden-style tariffs on Chinese EVs, so GM, Ford, and Tesla will be facing BYD and the other Chinese automakers on a more-or-less level playing field overseas (except in China itself, where the government will tip the scales in favor of its own domestic brands).

Chinese competition could thus push American and other car companies out of world markets. That would exacerbate the existing trend:

Source: StockDividendScreener.com

U.S. car companies — like European, Japanese, and Korean car companies — are thus in grave danger, tariffs or not. The EV transition is happening, and China is the best at EVs. That is a simple fact. Unless the Western manufacturers can raise their game, they are to be “cooked” globally and the tariffs will not save them.

Will the tariffs slow down the green transition?

A lot of people are worried that tariffs like these will slow down the transition to a low-carbon future powered by solar power and batteries.

They are right to worry. Transportation is responsible for almost 30% of U.S. carbon emissions, or about 4% of the global total. If the U.S. fails to switch to EVs, it could hamper de-carbonization efforts by a small but noticeable amount.

If tariffs are only placed on EVs made in China, there is not much to worry about. Americans will still switch to EVs, they will just buy their Chinese-brand EVs from factories in Mexico. The green transition will continue apace.

If the U.S. places tariffs on all foreign EVs, though, it could be a trouble. A refusal of GM and Ford to bet big on the EV transition (and Tesla’s pivot to robotaxis) would then be able to keep America as a gas-guzzling nation, clinging to outmoded comfort cars, orphaned from global technology and locked out of the high-tech future. And if Republicans turn EVs into a culture war the way they have done with lab-grown meat, they could enact restrictive state-level policies that would slow the transition even further.

Europe

The current stagnation of the EV market in Europe has been expected for years. It is the result of:

• The stop-and-go design of the EU car CO2 targets (in 5 year steps);

• Carmakers’ strategy to hold back the sales of EVs until it is required by the regulation, prioritising profits from ICEs and large, expensive EV models in the meantime.

In the stagnation phase, carmakers prioritise short-term profits through the sale of high-margin, expensive EVs and by pushing EV sales in the following year when they need the new models to reach the EU car CO2 targets. The disproportionate focus of carmakers towards larger, more premium models has resulted in high prices for EVs in Europe, which has slowed down EV sales as a result. In 2021, the average price of EVs was below €30,000 and the share of large EVs sales was close to 40%. By early 2024, the average price had increased by more than €10,000 and the share of large EVs sold increased to around 60%.

In the next growth phase from 2025 onwards, electric car sales will pick up as carmakers need to prioritise EV sales to meet the next car CO2 target kicks-in. Carmakers make a shift towards mass-market affordable EVs as they plan to launch ten affordable Made-in-Europe EV models in the next couple of years.

Calls to dismantle the 2035 100% zero emission car target would lead to a loss of investment and leave the European auto industry less competitive and further behind global rivals. Already today, with uncertainty over its 2035 zero-emission car target and a weak industrial policy, Europe is proving less attractive to electric vehicle manufacturers: Europe securing just over a quarter (26%) of global EV investment announced between 2021 and 2023. More than a third (37%) went to North America, despite the region being a smaller car producer.

EV tariffs alone will not deliver on the promise of the EU Green Deal. It is much more important for the deadline concerning ICE car manufacture in 2035 to be firmly observed. Currently, there are strong expectations within the EU that this deadline will be procrastinated. German car manufacturing companies are among the most active lobbyists for the put-off. Then the EU needs a more effective common industrial policy related to supply chain optimization and capacity enlargement. The present approach based on the national legislations of the member countries and the state aid regime is not sufficiently competitive and sustainable. The Green Deal cannot provide the promised jobs and growth without a good industrial policy in the entire EU. Within this context, it is no wonder that the Chinese import of EVs in Europe grows and perhaps even the tariffs will not stop it when the local manufacturing potential is weak. Practically the EU tariffs do not pursue growth-stopping objectives (each fourth EV in Europe is China-made). Their only positive feature is that they may enable the accumulation of three-quarters of the revenue that can be allocated to scaling up the battery supply chain via the EU Innovation Fund.

To sum up: the U.S. has some initial investment conceptualization for EVs manufacture development. Still, it has no policy and targets deadlines while the EU has policy regulations but lacks a relevant investment programme. Due to its politically fragmented structure, the EU will perhaps not be able to elaborate upon common programme any time soon. America lags considerably behind China in its overall industrial potential and it is difficult to figure out how it could reach the latter in EVs manufacture capacity also soon by building a competitive industrial vertical integration aimed at price affordable EVs manufacture. Both for the U.S. and the EU it is hardly imaginable a way to compete with China without Chinese investments in their own territories. Europe has already accepted some Chinese factories for EVs (still only in Hungary and Spain) and it is time for America to do the same. The knack of the state policies in the case therefore is related to the government policies on the share of these investments in the inevitable local EVs market growth and the control of the used parts in the production processes (especially about the mature chips utilization) to protect the national security of the Western countries.